-

New notaire data suggests easing of Paris property crisis

Property experts have talked of ‘easing pressure’ and ‘breathing space’ after a four-year slump

-

How to value a property for France's wealth tax

Here is how to check if you have to pay the impôt sur la fortune immobilière (IFI) – and how much it will be

-

New rules lower aid for home solar panels in France

Installation bonuses have also been cut as government looks to promote ‘self-consumption’ of power

Updated step-by-step guide to France’s property form (with pictures)

Around 34 million homeowners are required to submit information before the June 30, 2023 deadline

France’s new mandatory form for all homeowners (including second homes) is continuing to cause anxiety.

Tax authorities have received around 150,000 calls from people across France with questions about how to fill it in.

The Connexion has now updated its basic, step-by-step guide on filling it in to include screenshots.

We have also published several other articles that can help.

Read more: Problems continue with France’s new property form: where to get help?

Read more: Your questions answered on France’s new form for homeowners

Read more: How do I get a numéro fiscal to access the French tax site?

Step-by-step guide

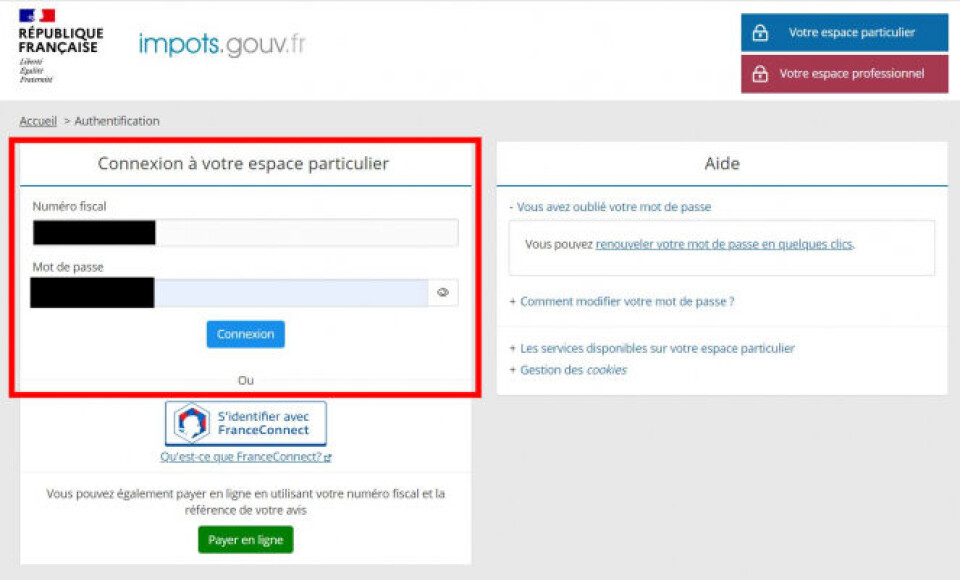

Step one: Go to impots.gouv.fr/accueil and click on 'votre espace particulier' in the top right corner of the website. Underneath, please note there is a link to follow the process in English.

If you are the owner of a property under an SCI, you need to click on 'votre espace professional' and then 'Démarches, then 'Gérer mes biens immobiliers'.

For this guide, we are looking at how individual homeowners complete the form which is via 'votre espace particulier' as shown here.

Step two: Log into the space using your numéro fiscal and password. If you do not have a numéro fiscal, read our guide here about this.

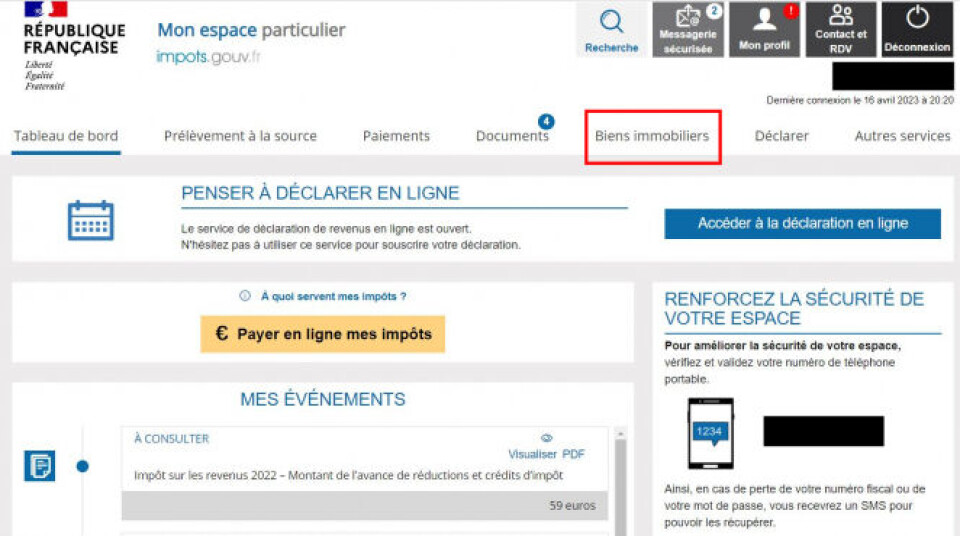

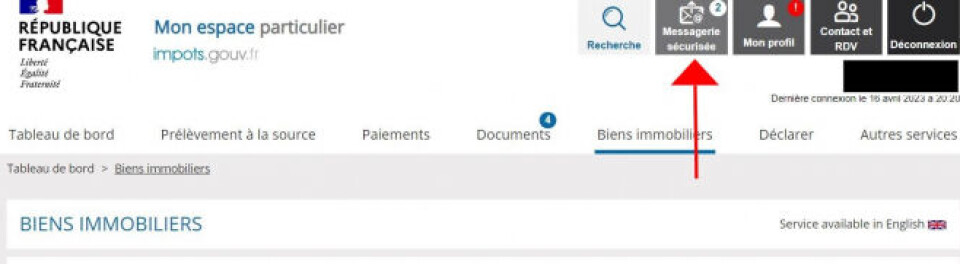

Step three: Click on the 'Biens immobiliers' section at the top of the page.

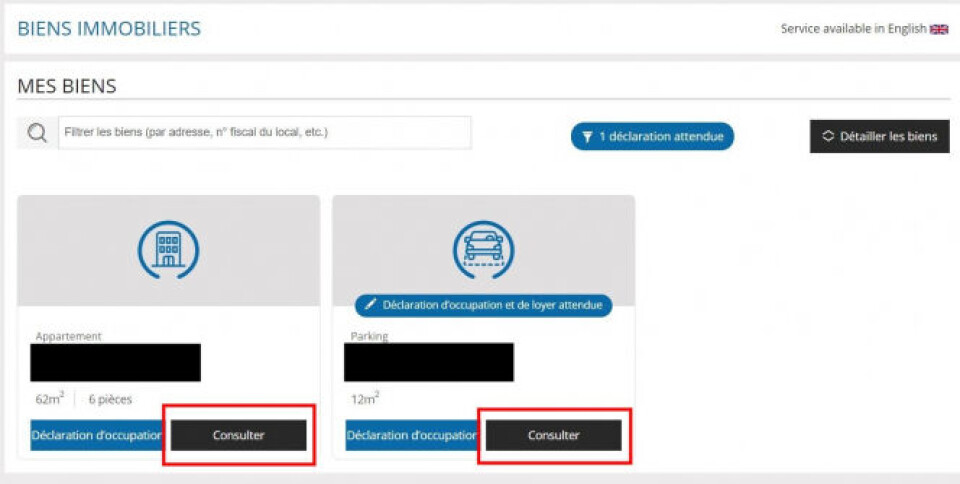

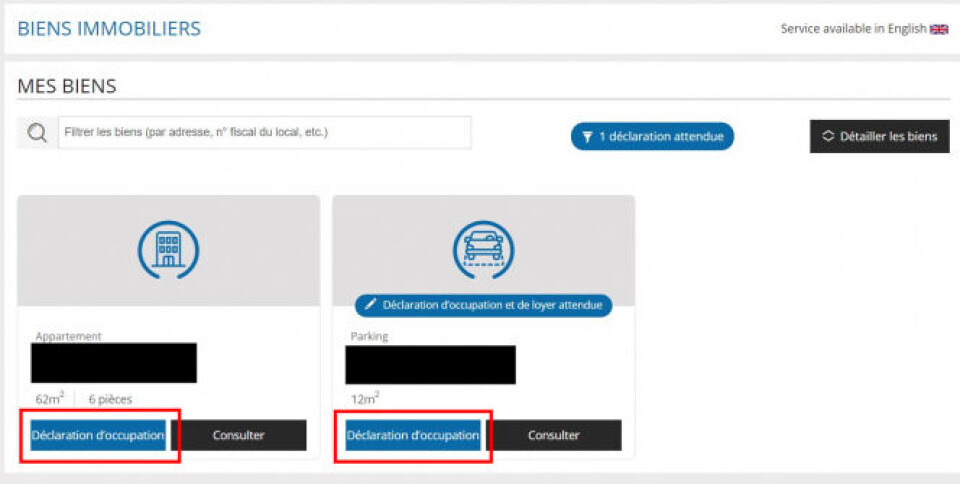

Step four: This page will show a list of the properties you own known to the tax authorities. For most people, this will only be one property. Click the 'consulter' button. This allows you to view what information the tax authorities have on your property.

Step five: Click 'déclaration d'occupation' to start the declaration.

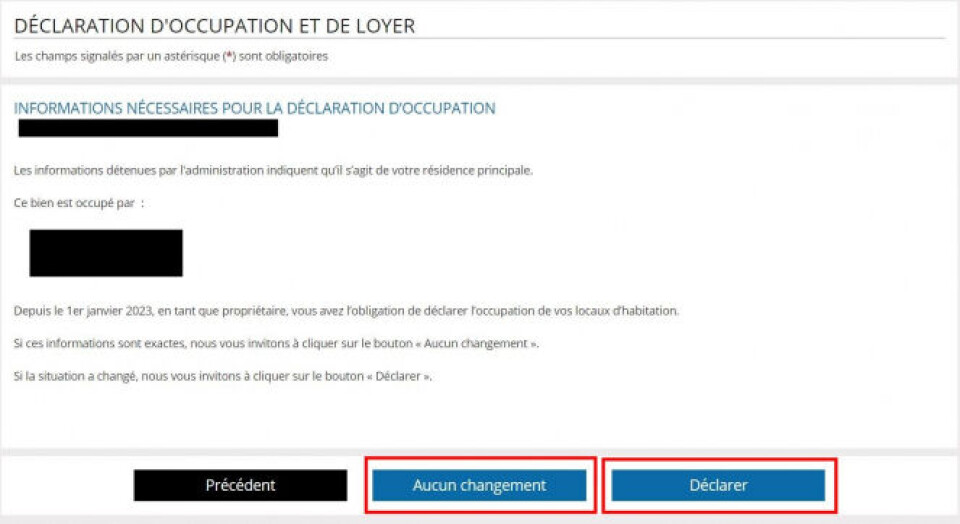

Step six: Check if the information is correct. As we have discussed in other articles, there may be discrepancies between points such the m² size of the property and the number of rooms and what you are familiar with from estate agent listings. This is because different methods are used.

Tax officials say in most cases the information listed for the property will be correct.

Step seven: If the information that appears is correct, you choose 'aucun changement'. You then double-check the information before clicking 'valider et transmettre'.

If you did not have to make any changes, you have finished and the form is complete. The information below is for people who need to declare changes to the information.

Step eight: If you need to declare new details or change existing ones, choose 'déclarer.

Step nine: You are then taken through a series of screens. What you see will depend on your individual situation, but here you will have the opportunity to add or change the information where necessary.

Step ten: If you have a question, or need to flag that your property details are inaccurate, you can send it to the tax authorities using the 'messagerie sécurisée' at the top of the page.

Step eleven: Once you are sure all the information is correct, you can click on 'validation et transmettre', as seen on the photo for step seven.

Some other hints and tips

As a reminder, it may be possible to complete the form by calling the services des impôts on 0809 401 401, although this can only be done if you are calling from within France.

You can find both an FAQ and user’s guide in English from the tax authorities on the website here.

Read also: Is there a way to call French 0800 numbers from outside of France?

A paper version is not available and the declaration must be completed online or by phone.

Although there is a deadline of June 30, 2023, to complete the form, a lenient attitude is expected this year.

Your feedback

Have you completed the form, or are you still finding it difficult? Is there anything preventing you from submitting the declaration? Are you a non-resident who is facing issues with the form? Let us know over at news@connexionfrance.com

Related articles

When is the deadline for filing your French tax return?

Five musts when you fill out your French tax return