-

Small business owners should watch out for incorrect payment demands from La Poste

The mistake stemmed from a ‘technical error’ during the roll-out of a new debt-collection system

-

What are the jobs you cannot do in France with ‘auto-entrepreneur’ status?

The status offers tax and administrative advantages, but has strict rules about the professions allowed

-

Many small firms and self-employed in France soon obliged to issue digital invoices

One small business group has called for more support for the extra costs

A guide to micro-entrepreneurs in France

Who can become an auto-entrepreneur? What is the annual turnover ceiling? How do micro-entreprises pay income tax and social charges and what benefits are they entitled to?

Almost two-thirds (64.8%) of new businesses up to September this year were micro-entreprises, national statistics bureau Insee data shows.

The regime is attractive because it is the easiest to set up and has simplified accounting, tax and social charge payment methods.

So popular is it that more new micro-entreprises are created year after year, including in 2020 (4% rise in new businesses overall, 9% in micro-entreprises), when most other European countries saw business creation drop.

- People who adopt the status are often still referred to as auto-entrepreneurs, even though the statuses of micro-entreprise and auto-entreprise were merged in 2016 and officially the term auto-entrepreneur was replaced by micro-entrepreneur. Even the Urssaf website, which is the point of contact for most of the administrative tasks, still uses the term.

Most micro-entrepreneurs work alone but they can have an employee. Spouses or Pacs partners can opt for a status of conjoint collaborateur or conjoint salarié if they are involved.They need to provide a sworn statement relating to this.

Artisan, commerce or profession libérale?

They can set up as an artisan, commerce or profession libérale, the latter term covering a wide variety of jobs which do not fit under the other two categories and are not industrial or agricultural.

Examples include being a sports coach, mountain guide, translator or designer.

Note that as a sole trader with a normal micro-entreprise there is no limited liability, so your own possessions are at risk in the case of debts. However, there is a set-up called AERL that protects against this.

Anyone resident in France can become an auto-entrepreneur, but will need a relevant visa/residency card if they are not a French national or from an EU country. Since Brexit, Britons must hold a visa/residency card permitting them to do self-employed work (this includes the Brexit WA cards).

A micro-entreprise can be the main source of income or a supplementary venture in addition to a salaried job, studies or in retirement.

Annual turnover must be lower than €176,200 for commercial activities, and lower than €72,600 for services and professions libérales.

You only have to be concerned with VAT after set turnover limits: for example, €94,300 in a year for the sale of goods.

Paying income tax

There are two ways of paying income tax. One is to include it as part of the annual household declaration. Another, versement libératoire de l’impôt sur le revenu, is to pay regularly at the same time as social charges, at set rates depending on the type of work (for example, 1% of turnover for selling goods).

Social charges

Social charges can be paid monthly or quarterly. They are calculated as a fixed percentage of your turnover, depending on the type of work.

Rates are 12.8% for the sale of goods, 22% for artisanal and commercial services, 22% for professions libérales attached to the standard Assurance Retraite for retirement, and 22.2% for a small number of professions libérales attached to Cipav. There is an additional levy of 0.1% to 0.3% which goes to the CPF fund giving all workers the right to a financial contribution for training.

Payments are made online via your personal account at autoentrepreneur.urssaf.fr or via the mobile phone app AutoEntrepreneur Urssaf.

How to set up as a micro-entreprise?

Setting up can be done online at autoentrepreneur.urssaf.fr by clicking on Créer mon auto-entreprise.

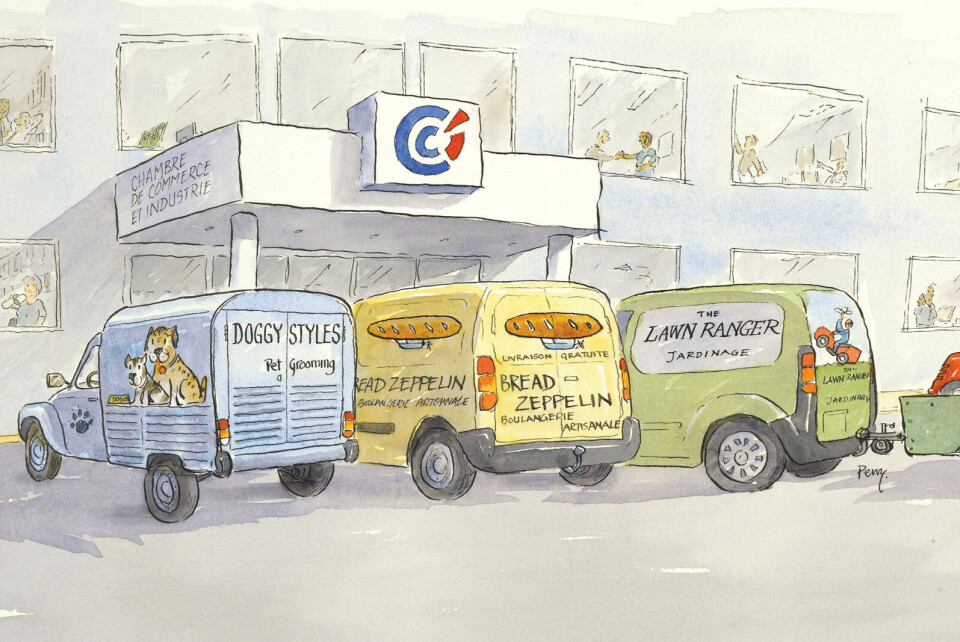

The first step is to create an account, then give details of your intended work, and social security numbers. You must then send off the declaration, which is registered with the relevant centre de formalités des entreprises. For commercial businesses, it is with the chambre de commerce et d’industrie, for artisans and some other commercial businesses it is with the chambre de métiers et de l’artisanat, and for professions libérales it is with Urssaf.

New micro-entrepreneurs should receive a Siret number (business registration number) in eight to 15 days, and notification they have been signed to the relevant social security regime, notification d’affiliation, in four to six weeks.

Since 2020, all independent workers belong to the ordinary regime for health, Assurance Maladie, and all but some professionnels libéraux are signed up to the standard Assurance retraite for their pensions. The centres de formalités hold courses on setting up. Get in touch with your local chamber for dates and prices.

Sick leave has only been available from the state to independent workers since July. To benefit, you have to have been a micro-entrepreneur for one year and your average annual revenue must be over €4,000. It is paid after the third day off sick, with presentation of a doctor’s note.

The daily amount, indemnité journalière forfaitaire, is 1/730th of your average annual income. For example, you will receive €34 a day if your declared turnover is €25,000.

There is a maximum payment of €56.35 a day.

Maternity and paternity

Independent workers can also receive an indemnité journalière forfaitaire for maternity and paternity leave.

Sick leave is not as generous as for an employee, who receives a payment from social security equal to 50% of the daily basic wage, usually topped up by the employer up to 90% after the seventh day of illness. Unemployment benefit was introduced for independent workers in 2019 at a rate of €26.30 a day, around €800 a month, for six months.

To qualify, the business must be at least two years old, with an annual turnover of €10,000 and it must have gone into legal liquidation.

Grégoire Leclercq, director of the Fédération Nationale des Autoentrepreneurs et Micro-entrepreneurs, which fights the cause of micro-entrepreneurs and offers information and advice to members, told The Connexion he believes it will benefit very few auto-entrepreneurs because the liquidation procedure is very expensive, at around €3,000.

However, he said the regime is attractive for many people with a small business idea (and not too many expenses), despite extra complexity being introduced over the years.

Related stories

What is the difference between 'auto/micro-entrepreneur' in France?