-

Customs: What allowances are there to take household items from France to UK?

Personal goods allowances change depending on how you arrive in the country

-

How young Britons in France can get a residency card at 18

The children of Brexit Withdrawal Agreement card holders need to apply for the right to stay

-

Letters: Brexit benefits for Britons in France

Connexion readers share their experiences

Make sense of duty-free shopping in France

Brexit has brought the return of duty-free shopping for France-UK travel, but this does not always equal savings. We explain more

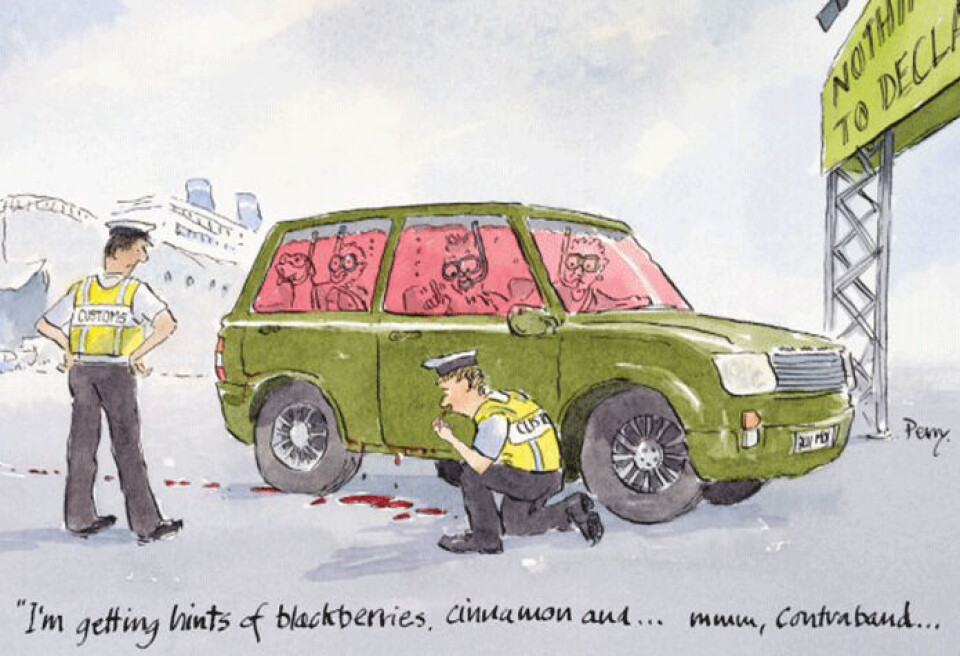

Our main image was drawn for The Connexion by artist Perry Taylor. For more of his work see www.perrytaylor.fr

Even when the UK was a proud member of the European Union, duty-free shops (for non-EU travellers) were big business for France.

The giant LVMH luxury goods consortium is a co-owner of DFS, one of the world’s largest duty-free retailers, with 400 locations.

The business is – outside of pandemics and global economic crises – one of its cash cows, reflecting the love people have for perceived bargains.

Lagardère, another giant French consortium, also has a stake in duty-free shops.

Looking at a map of DFS stores, one point jumps out: there is only one in Europe, in Venice; three are in continental US; and all the rest are in the Asia-Pacific region.

In part, that reflects the fact that the EU has open internal borders with free trade among its members.

‘Duty-free’ shopping does not apply within the zone, and there are no specific limits, in type of goods or value, when bringing in items for personal use (as opposed to resale) within the bloc.

Brexit saw the re-introduction of duty-free shopping from the EU

In January 2021, with Britain leaving the EU, the UK government announced the return of duty-free allowances for travellers bringing goods in from the EU as one of the claimed benefits of Brexit.

Travellers leaving the UK can also buy alcohol and cigarettes free of UK excise duty in British duty-free shops in airports and international railway stations or on ferries.

In fact, the UK increased its allowances from what they were before it joined the single market, allowing travellers coming from the EU to bring 42 litres of beer, 18 litres of still wine (24 standard bottles) and four litres of spirits or nine litres of sparkling wine, fortified wine or other alcoholic drinks of less than 22% alcohol.

For smokers, 200 cigarettes, 100 cigarillos, 50 cigars, 250g of pipe tobacco or 200 sticks of tobacco for electronic heated tobacco devices are tax-free.

Duty-free limits on other goods brought into the UK were set at £390 for most travellers, or £270 for those travelling by boat.

If you exceed the limits, whether by type of good or value, you are taxed on the whole quantity of the items in question and not just the part exceeding the limit.

For travellers coming to France from outside the EU, duty-free limits are the same for tobacco products but less generous for alcohol.

Only one litre of spirits is allowed, two litres of wine or drinks of less than 22% strength, three litres of wine, or 16 litres of beer.

If you import more – for example, you bring 20 litres of beer from the UK into the EU – you cannot claim 16 litres duty-free and four litres with tax. The whole 20 litres will be taxed.

Duty-free limits by value for other goods entering France are €430 for air or sea passengers, including the ferry, €300 for people entering by car, train or coach, which includes people using the Eurotunnel, Shuttle and Eurostar trains.

When crossing borders in or out of the EU, attention also has to be paid to rules relating to food. For example, you cannot take French unpasteurised cheese to the US.

Is buying duty-free goods even worthwhile?

Whether buying duty-free goods while travelling is worthwhile is another question: duty-free shops might be exempt from tax but they pay high rents in terminals or shopping centres and their owners obviously aim for a profit.

A recent study by the travel website Skyscanner found that spirits in French supermarkets are usually 25-30% cheaper than in duty-free shops, and chocolates 40%.

It found that only perfume was sometimes cheaper in duty-free shops, giving the example of 90ml of Burberry perfume which cost €98 duty-free and €115 in French shops.

Whether or not something is a good deal to you will also depend on any exchange rate changes and special offers.

Another aspect of duty-free shopping is that some French shops allow non-EU visitors to buy ‘touristy’ goods such as clothing and watches VAT-free or, more usually, with a refund to be claimed at the port/airport before check-in on leaving.

In the latter case, the refund still ultimately comes from the retailer, not French customs.

This is called la détaxe and some ports/airports have special terminals for it.

However, none of this stops import taxes being potentially payable on items on arrival in the destination non-EU country.

For the extra formalities to be worthwhile, there has to be a significant benefit from obtaining the French VAT discount (20% on most purchases) and for the goods to be expensive to compensate for the form filling.

In any case, to be applicable, a purchase on a given day with a given shop must usually be for more than €100 including VAT.

Strong for Asian visitors to France

The advantages in recent years have been particularly strong for Asian visitors to France and many swish Paris stores have dedicated staff to help customers from places such as Japan and China.

Britain scrapped VAT-free shopping for tourists after Brexit, then brought it back, and then scrapped it again.

HMRC said that with regard to declaration and taxes on entry, it makes no difference if the items were taxed or not in the country where they were purchased or whether you bought them on the high street or in a duty-free shop.

A spokeswoman said they will just look at the allowances and tax you, if appropriate, based on what you paid.

Depending on the category of goods, the UK may levy excise duty and/or VAT as well as customs duties – though items made in the EU are usually free of the latter.

Much the same applies on entering the US, where the allowance is $800 per traveller.

There is a lot of folklore surrounding duty free rules – for example, some people say if you buy expensive clothes abroad, wear them and have them cleaned, they do not have to be declared at customs if you wear them while travelling home.

Others think opened bottles of spirits do not count. However, customs officers said normal duty-free rules apply to both of these cases.

Related articles

What are alcohol limits for France-UK travel? Per person or per car?

Are France-UK duty-free allowances per person if you are in a car?

Will Brexit mean caps on taking alcohol from France to UK?