-

How to set up a fuse box in a French home

Columnist Nick Inman charts the ups and downs of renovating an old French farmhouse

-

How to arrange a green funeral in France

Obsèques écologiques have been slow to gain popularity in the country

-

Taxe foncière: how to ask for delay, reduction, or cancellation of French property tax

Taxe foncière relief is possible at any time

How to work out if you owe French property wealth tax in 2022

Impôt sur la fortune immobilière is payable by households which owned more than €1.3million in real estate assets on January 1

If you owned French real estate assets worth more than €1.3million on January 1, 2022, you may be subject to the impôt sur la fortune immobilière (IFI) property wealth tax.

In 2020, 143,000 French tax households paid €1.56billion in IFI.

If you have eligible property wealth it is your responsibility to make a declaration.

Read more:Explained: France’s property wealth tax is not as scary as you think

What is IFI?

IFI applies to built buildings and undeveloped property including land as well as certain investments where property-owning is a key factor, such as shares in an SCI.

The IFI owed will be calculated based on the value of the property concerned on January 1 of the year in question. However, a person’s main residence benefits from a 30% reduction on its value.

There are also certain other reductions and exemptions, for example the €1.3million does not include property used for your main occupation, including shops or offices for example.

Professional furnished rentals would also count as property required for the pursuit of occupation.

In addition, exemptions are applied to land given over to woodland or farming purposes.

Savings accounts, life insurance schemes, furniture, cars, jewellery, works of art and other movable goods are not subject to IFI, only property in the land or bricks-and-mortar sense.

However IFI can also relate to property ‘rights’, such as a lifetime usufruit right to use the land, and to certain shares if they relate to investment in real estate, or if of a mixed nature, in proportion to the investment in real estate.

Resident or non-resident?

If you are a resident of France then you are assessed to the IFI tax on worldwide property holdings. For non-residents it mostly relates to properties and property rights in France and companies set up to own property there.

For people moving to France there is also an exemption for foreign assets until the end of the fifth calendar year starting after the year when you became fiscally resident.

How is it calculated?

The amount payable is calculated based on the circumstances of the tax household in question.

A single person living alone would count as a single tax household, as would a married or cohabiting couple.

The tax authorities will take into account all of the property owned by the tax household as a whole, rather than the individuals within it.

There do exist deductible liabilities including ongoing property loans, debts relating to construction or improvement works and as yet unpaid property ownership tax (such as taxe foncière).

For example, if someone bought a property worth €4million to be their main home and took out a loan of €2million to finance the purchase, then the value is subject to a 30% reduction as the main home, giving a declarable value of €2.8million from which the outstanding finance can also be deducted.

This potentially leaves only around €800,000 which is below the threshold to pay the tax if no other taxable property is involved.

Deductible liabilities are calculated according to the amount that was still owed on January 1 of the year in question.

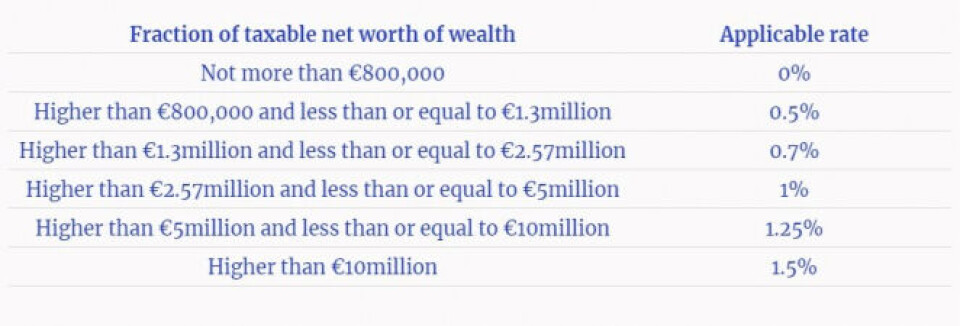

When the net value of the assets exceeds €1.3million, IFI will be charged on a progressive scale of six bands ranging from 0-1.5%.

Although your assets are assessed for IFI on property exceeding €1.3million in value, in practice it will only be applied to the proportion of your assets which exceed €800,000 in value as the first, zero-rated, band is up to that amount.

If, for example, the net taxable asset value sits between €800,000-€1.3million, tax will be applied at a rate of 0.5%, while for property worth €1.3million-€2.57million it will be 0.7%.

Discounts and exceptions

Households with property worth between €1.3million and €1.4million can benefit from a reduction in their IFI due to a calculation called the décote.

Also, if you are a French tax resident, the amount you pay in IFI may be capped (income tax and social charges on 2021 income plus 2022’s IFI should not be more than 75% of 2021’s income).

There are also various possible reductions, for example, IFI tax payable can be reduced if the household in question donates a certain amount to charity over the course of the year.

IFI declarations should be made by the same date as French income tax declarations.

If you are a French resident or a non-resident who has income to declare to France, then in most cases you will do this via your personal space at impots.gouv.fr as part of the online income declaration, by selecting the Impôt sur la fortune immobilière option when choosing the sections you require.

People declaring by paper should use a 2042-IFI form which can be found using the search box at the tax website (check you have the one for 2022).

If you are not subject to French income tax, you should fill in a 2042-IFI-COV form as well as the 2042-IFI.

This year, the deadline for returning paper declarations is May 19.

For online declarations coming from departments 1 to 19, non-residents and Monaco, the deadline is May 24, while for departments 20 to 54 it is May 31 and for departments 55 to 976 it is June 8.

Related articles

Online tax declarations open: One update is for Britons post-Brexit

Can I rent out my refurbished outbuilding to a student in France?

Bargain homes: Eight properties for less than €50,000 in France