-

Property prices rising in France but buyers still negotiating

New figures suggest that it is still a ‘buyer’s market’ - but this may not last

-

House price falls accelerating in France: will this continue?

Leading estate agent groups report a fall in prices, making it a ‘buyers’ market’ after months of high interest rates and political uncertainty

-

Larger houses struggling to sell as post-Covid boom disappears

Purchasing power is decreasing but for those with funds, it remains a buyer's market

French property prices: should buyers - or sellers - wait?

Latest data shows signs that the fall is slowing in some areas and may rebound later this year

House prices are falling in France after a year of stagnating sales and high inflation, however the latest data indicates that the drop is slowing in some areas. We look at whether buyers - or sellers - should wait.

The French housing market struggled in 2023, with the Notaires de France recording 20% drops in sales in Hauts-de-France, Normandy and Occitanie, despite house prices resisting in those areas.

In January, France's largest real estate agency, Century 21 stated that “prices have to go down” in 2024 in order to resuscitate the flagging housing market.

Early signs in 2024 have so far confirmed that prices are falling. Indeed, they started falling in Paris last year, however the trend has since spread throughout the country, with prices dropping below the rate of year-on-year inflation everywhere, according to notaire data from January.

Are house prices still falling?

While prices are still dropping nationally relative to year-on-year inflation, the rate of the fall appears to be slowing according to a new report on sales prices by online estate agents Meilleursagents.com.

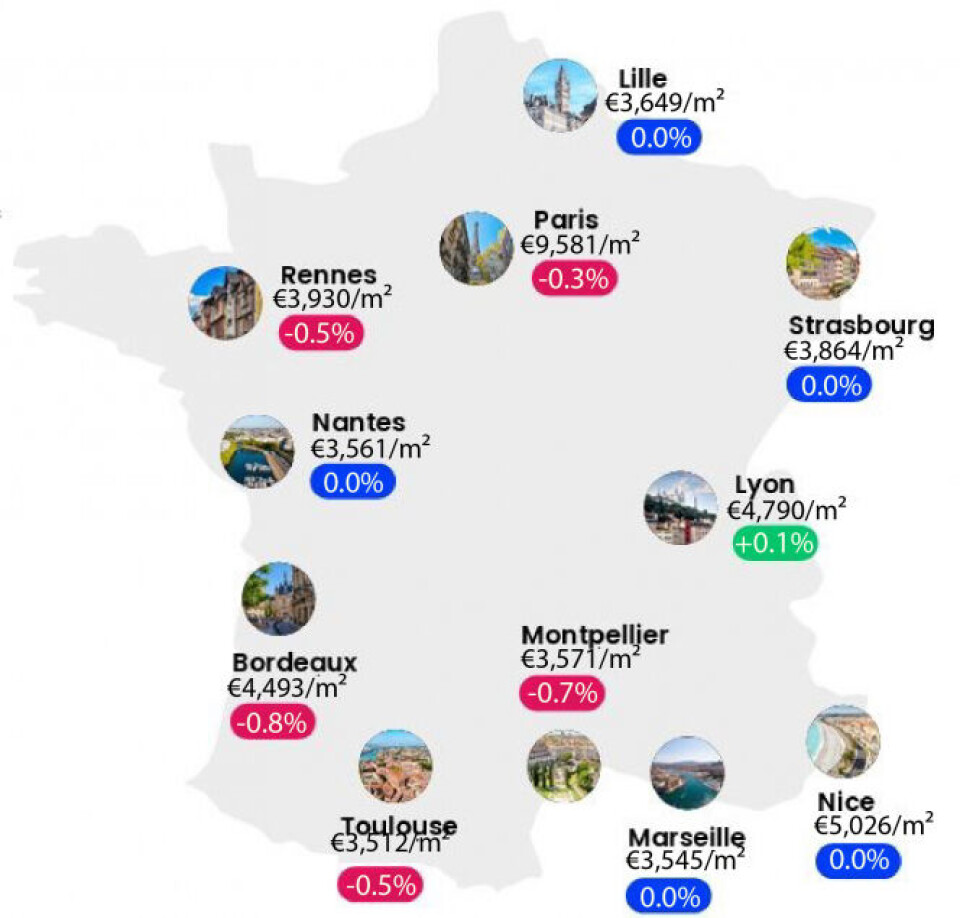

Paris, which was ahead of the national trend in terms of the price drop, registered a 0.7% drop in prices in November, then 0.6% in December but only 0.3% in January.

Five other cities saw their prices remain unchanged in January after registering decreases in December. In Lyon prices increased by 0.1% in the first month of the year.

“After a traditionally sluggish final quarter, it usually takes two or three months for the market to recover at the start of the year,” said Meilleurs Agents in its report.

“In 2024, this recovery appears to be occurring much earlier than it did last year. In comparison, Paris property prices slipped in January 2023 just as they had in November and December 2022.”

Read more: MAP: See house price changes near you in France in new notaire data

Changes in house prices December 2023 to January 2024:

Nonetheless, price drops have continued to accelerate in rural areas, which saw a fall of 0.3% in November 2023, 0.5% in December and 0.6% in January 2024, according to the report by Meilleurs Agents.

Read more: How do I estimate the value of my rural home in France?

Positive signs from European Central Bank

On January 25, the European Central Bank (ECB) announced that it would keep its three key interest rates unchanged. In a press release, the ECB said the move was intended “to ensure that [year-on-year] inflation returns to its 2% medium-term target in a timely manner”.

This measure was welcomed by Franck Sédillot from the Banque de France as “allowing banks to fluidify their mortgage offers”.

The ECB also indicated that these key interest rates would be lowered in June, a move already anticipated by French banks, which have reduced their mortgage rates by 0.2 points since the start of the year.

In another early sign of recovery, banks are starting to demand lower mortgage deposits than they did in December 2023 according to a report by BFM Business.

The average deposit in February 2024 is €54,798, compared to €64,942 in December 2023 - a reduction of €10,000.

The overall picture appears to suggest that property prices are likely to begin to stabilise in urban areas over the coming months, followed by rural areas, then potentially rebound from the third quarter of 2024.

Read more:

Americans flock to buy in Paris, spending a median of €715,000