-

Britons are the largest foreign community of second-home owners in Nouvelle Aquitaine

See which other departments in the region are popular with British nationals

-

Travellers risk extra costs under new Eurotunnel ticket rule

Some fare options are less flexible and less forgiving of lateness

-

May will be difficult month for train travel in France, warns minister

Two major train unions are threatening to strike and are ‘not willing to negotiate’, he says

British pound crash: France’s pension top-up benefit may help

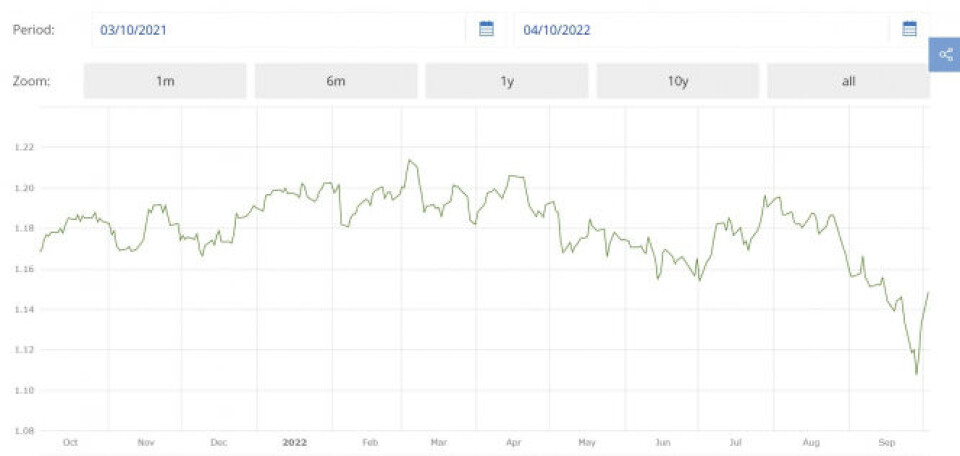

We look at a government aid that British pensioners in France could be eligible for after the British pound’s value against the euro plummeted at the end of September

British retirees living in France and receiving their pension from the UK are at risk of a financial hit after the British pound fell to its lowest level against the euro in around two years at the end of September.

The pound also reached record low levels against the US dollar after the UK’s Chancellor of the Exchequer, Kwasi Kwarteng, unveiled a ‘mini-budget’ on September 23 that included plans for tax cuts costing £45billion.

The pound recovered somewhat against the dollar and the euro after Mr Kwarteng and British Prime Minister Liz Truss met officials at the Office for Budget Responsibility on September 30, an act that has had a reassuring effect on market speculation.

The government then made a u-turn on scrapping the country’s top rate of income tax, which has also helped the pound’s recovery.

The graph shows the British Pound vs the Euro between October 3 2021 and October 4 2022. Credit: Screenshot / European Central Bank

Several experts have said that while the pound has recovered since the mini-budget announcement, the government’s actions since then are not necessarily enough to restore its prior strength.

This is obviously a concern for British retirees living in France who receive their pension in pounds.

The good news is that France has a pension top-up benefit that British citizens covered by the Brexit Withdrawal Agreement are eligible for.

It is called the Allocation de solidarité aux personnes âgées (Aspa).

To receive this benefit, your income must be below a certain threshold.

For a single person it must not be above €953.45 per month of gross income whereas income as a couple should not exceed €1,480.24 per month.

There are various other conditions that you must meet, such as being over 65 and having your main residency in France.

Aspa tops up your income to the levels mentioned above.

So, when only a single person receives it, the maximum amount that could be paid is €953.45 per month and when both members of a couple (married, pacsed or civil partnership or long-term partners) receive Aspa, the maximum total amount paid is €1,480.24 per month.

By way of example, if as a single person your income is €800 per month, the top-up from Aspa will work out as:

€953.45 - €800 = €153.45 per month

Note, that for European citizens and Britons benefiting from the Brexit Withdrawal Agreement, being a resident of France and having income under the ceilings are the main criteria.

Other non-French and non-European citizens living in France are (with a few other exceptions such as refugees) required to have held, for at least ten years, a residency permit allowing them to work in France.

You can read more about Aspa and how to apply for it in our explainer article here: Can foreign residents claim France’s pension top-up benefit?

Related articles

Five tips to enjoy a long and financially secure retirement in France

These four benefits must be repaid from your estate after death

Rural French regions offer great retirement prospects