-

What’s new in April 2025 for residents in France: 9 key changes

Several fiscal changes take place as income tax declarations begin

-

Five questions for British and American drivers in France on new driving licence rules

Digital licences will be widespread by 2030

-

How to listen to BBC radio as broadcaster ends access to Sounds app in France

Corporation ends service due to licensing issues, but listeners are not happy

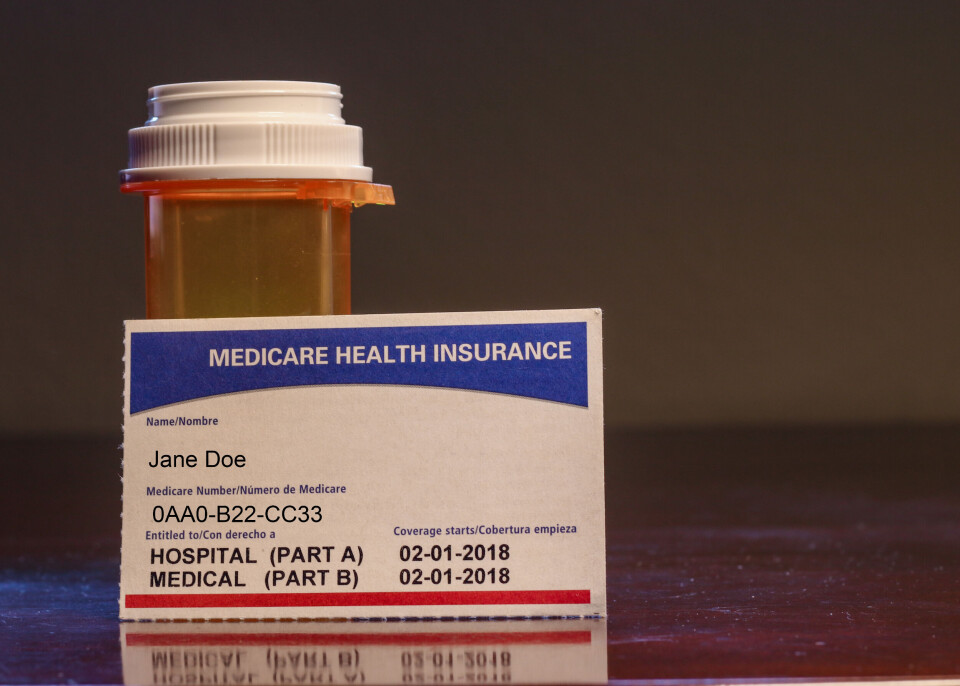

Can I belong to US Medicare and the French healthcare system?

We look at the rules for Americans living in France who want to retain their Medicare health plans

Reader question: I am an American retiree receiving social security and a private pension, still paying for Medicare Parts A and B and subscribing to a Medicare Advantage health plan.

Is it mandatory to join the French healthcare system and is it possible to be a member of both?

I believe that, as a French resident, I must pay CSG-related taxes: do these cover French healthcare, and so could I be paying for services I am not using?

First, while retaining Medicare will allow you to visit your doctor when you return to the US, it will not cover your care while in France.

Generally, Medicare will not pay for healthcare outside of the US, except in a limited number of situations, none of which apply to France.

Read more: Explainer: Paying to see a doctor or health specialist in France

It appears there is nothing to stop you keeping Medicare Parts A and B while also joining the French healthcare system.

It is also worth noting that you are unlikely to be able to continue benefiting from your Medicare Advantage plan.

A spokesman for Centers for Medicare & Medicaid Services said: “For Medicare Part C [Medicare Advantage] enrolees, the beneficiary’s permanent residence must be inside the plan service area.”

You can only be absent for up to six months in a row (or 12 months for some Advantage plans with a visitor/traveller benefit), otherwise you will lose your eligibility.

Parts A and B are not subject to the same geographical requirements.

The contribution sociale généralisée (CSG) is a tax that goes towards funding France’s social security system, including healthcare.

It is due on many forms of revenue, including pension payments.

The French-US tax treaty recognises this as a tax, and allows Americans to deduct this when declaring their income to the IRS, Lyon-based accountancy firm Roche & Cie confirmed to us.

However, under the treaty, most forms of US retirement pension are not taxable in France, so you are unlikely to owe CSG on this income.

In any case, since the CSG is essentially a tax rather than an ordinary social security contribution, it does not confer any right to benefit from the French social security and health system (unlike cotisations paid by workers, for example).

Joining the French healthcare system is not mandatory

Joining the French healthcare system is not mandatory, but “very much advised” if settling in France, according to Diana Nyerges, a relocation specialist at French Connections HCB.

“However, all residents of France must have some form of health insurance, whether state or private.”

The most likely way you would access French healthcare is through protection universelle maladie (Puma).

This guarantees healthcare access for residents, regardless of whether they have paid into the system.

You can complete a 15763*02 form and return it to your caisse primaire d’assurance maladie.

Puma is either free or at a variable charge based on income for those with substantial ‘capital’ incomes (eg. from investments).

In theory, residents can be liable to pay this even if they do not use the French system, according to Urssaf, the agency responsible for collecting it.

Related articles

What help is there towards top-up healthcare insurance in France?

Explainer: French healthcare terms that are useful to know

Am I assigned a doctor in France or do I need to register?