-

Four major French banks to share cash machines to better serve rural areas

The partnership is aiming to position ATMs more strategically and usefully

-

The new tougher rules for claiming RSA low-income aid in France

Recipients of the benefit now have to draw up a ‘commitment contract’

-

Is there financial help to purchase a mobility scooter in France?

Some UK disability benefits remain for Britons living across the Channel

Explainer: France’s ZRR schemes and how they benefit rural communities

17,730 communes are classed as ZRRs in France with the aim of helping them to attract businesses to set up there

In France, certain rural areas can be given a special classification in order to help attract businesses by offering them financial incentives.

These areas are called zones de revitalisation rurale (ZRR).

In order for a commune to be classed as a ZRR, they must:

-

Have a population density less than or equal to 63 inhabitants per square kilometre

-

Have a median tax income per household of less than or equal to €19,111 per year

There are 17,730 communes classed as ZRRs in France. Of these, 36 only have partial status as not the whole commune is a ZRR.

The ZRR scheme will remain in place until at least December 31, 2023.

Some communes have lost their status as a ZRR due to criteria being updated but continue to benefit from social and financial benefits offered through the scheme. There are also certain mountain communes that receive similar benefits despite not being ZRRs.

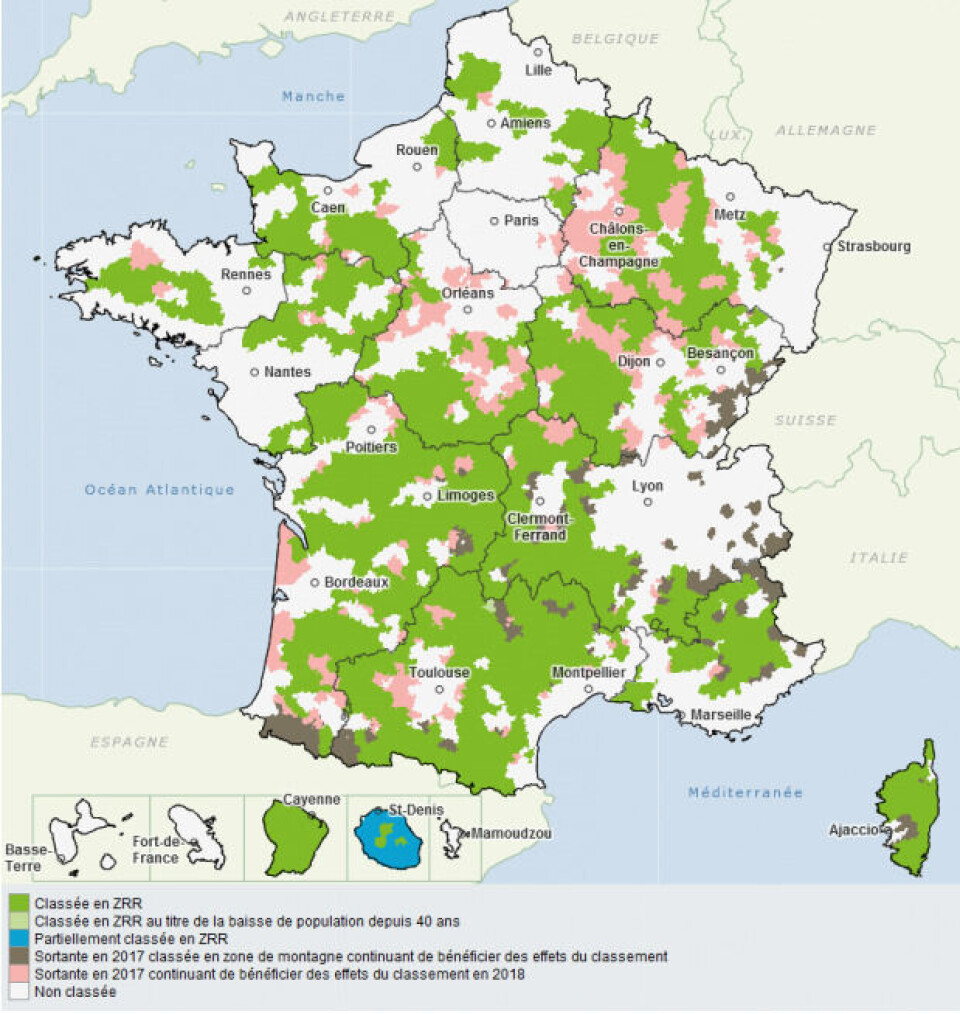

A map below shows communes that are ZRRs (green) and others that continue to receive similar benefits to ZRR communes for various reasons.

Photo credit: Screenshot / observatoire-des-territoires.gouv.fr

You can see a full list of ZRR communes here – scroll down until you see the link “Télécharger la liste des communes classées par les arrêtés de classement en ZRR”.

Financial benefits for businesses in ZRRs

To encourage local development and recruitment, companies wishing to set up in ZRRs benefit from tax exemptions linked to the number of employees and the nature of their activity.

To find out more about eligibility, you can speak with an advisor at the government’s Place des Entreprises – see more information at this link here.

Companies in ZRRs can get:

-

An exemption from income tax or corporation tax on profits made

-

An exemption from the territorial economic contribution tax (contribution économique territoriale or CET)

-

An exemption from the business property contribution tax (contribution foncière des entreprises or CFE) and the business value added contribution (contribution sur la valeur ajoutée des entreprises or CVAE).

-

An exemption from paying taxe foncière for brick and mortar businesses and an exemption from housing tax (taxe d’habitation)

-

An exemption from social security contributions (cotisations sociales) as an employer

-

An exemption from paying employers' social insurance (cotisations patronales) and family allowance contributions (allocations familiales) for the first 50 employees hired for the first year of employment.

Rural business revitalisation zones

A similar initiative has also been set up to help develop local shops in rural areas. Some communes have been placed in zones called zones de revitalisation des commerces en milieu rural, or ZORCOMIR for short.

People setting up shops in these zones can also benefit from tax breaks.

The government states that 25% of people living in rural areas of France live in a commune without any shops.

“The preservation or revival of local commerce is essential for the development and attractiveness of rural areas,” France’s ministry of territorial cohesion states.

Read also

French rural residents ‘must be protected from pesticides’

Exemptions and reductions extended for the taxe foncière in France