-

‘Round up’ banking enables people in France to save without realising

The method is seen as a way for shoppers who might normally struggle to save to build up extra cash

-

Is it better for partners to have a joint bank account in France?

There are rules to consider about who owns the funds and what happens if the couple separates

-

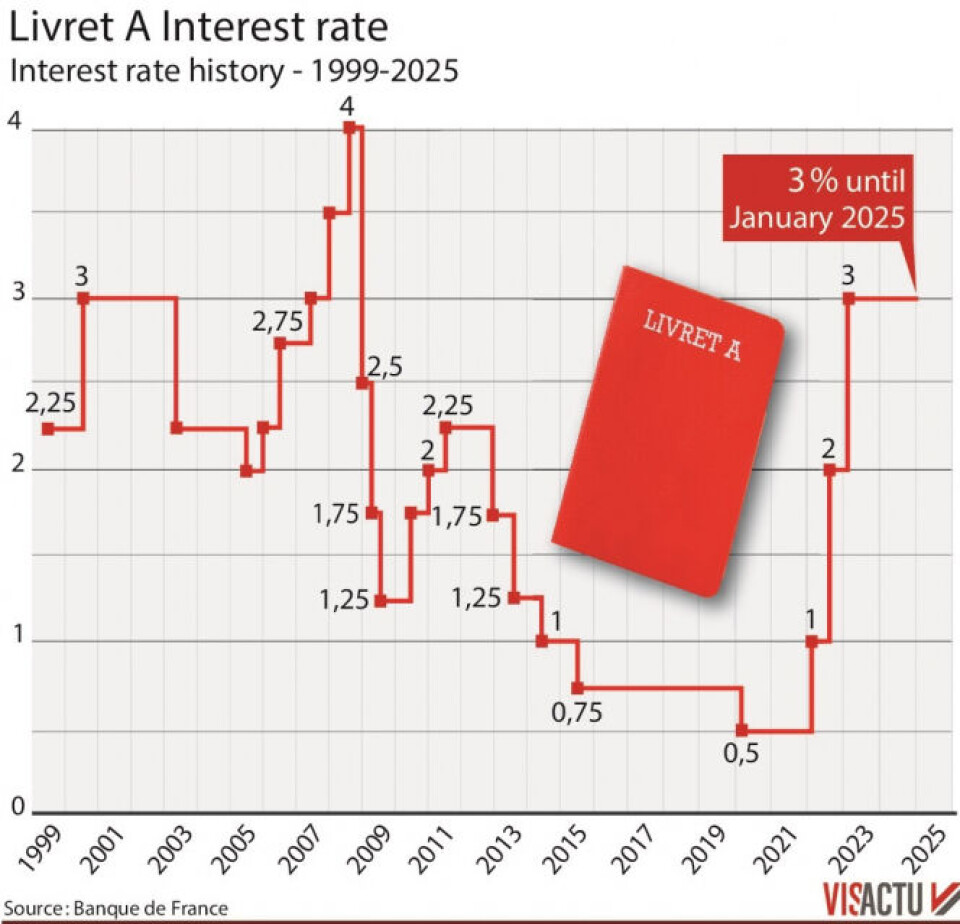

3% rate on France’s main regulated savings account to stay this year

Court rejects appeal by law professor for twice yearly updates as is set in the rules

France will keep Livret A savings rate the same for next 18 months

There are more than 50 million Livret A accounts in France

The interest rate of France’s best-known savings account – the Livret A – will continue to provide a 3% interest rate for at least the next year and a half.

The measure was announced by Finance Minister Bruno Le Maire, who said he made the decision for “reasons of national economic interest”.

It comes after the Banque de France also proposed to keep interest rates for the savings account at 3%.

The Livret A is a state-regulated, tax-free savings account. The French government sets the interest rate and deposit ceiling and uses the funds deposited in the Livret A to fund projects such as social housing and urban renewal.

The economic model used to calculate the interest rate of the account – which is seen as a low-risk investment due to the government’s involvement – should have risen to 4.1% as a result of inflation.

There are more than 50 million Livret A accounts in France and savers may see the lower rate increase as harsh amid the high prices in shops.

Read more: Livret A savings: Why are they so popular? How do I open an account?

Two reasons for choice

Two main reasons were given for keeping rates at their current levels.

The first was the falling inflation levels in France – the Banque de France said a raise now could lead to a large drop next year, causing volatility for account holders.

Secondly, an increase would be “detrimental to economic growth,” with none of France’s European neighbours having an “equivalent” regulated savings account.

Historical analysis

For an insight into how the Livret A interest rate has shifted over the years take a look at our graphic below:

Further announcements made

The finance minister did, however, keep the interest rate of the Livret d’épargne at 6% “although it should have been lowered”.

This is a savings account for those on modest incomes, which allows them to save up to €470 per year.

The final announcement was regarding plans épargne logement (PELs) or home savings plan loan.

Previously, owners had to wait up to four years to use money in the account to buy a home, but now money from the account can be used “whenever you want” for ecological renovations to a property.

Around eight million people have a PEL account in France.

Read more

Five French alternatives to leaving money in current accounts

What do I do with my French livret de famille?