-

Mayors in south-west France asked to sign petition for door-to-door bin collections

‘The aim is to make our voices heard in parliament’, organiser says

-

Steep rises in home rubbish collection fees for several areas of France

Some councils plan double-digital rises to the rate they apply. Fly tipping is an issue in Dordogne

-

Property tax deadline is extended in France after website crashes

Thousands logged on simultaneously to pay their taxe foncière bill just before midnight deadline

How much has the ‘rubbish bin’ tax for French homes risen this year?

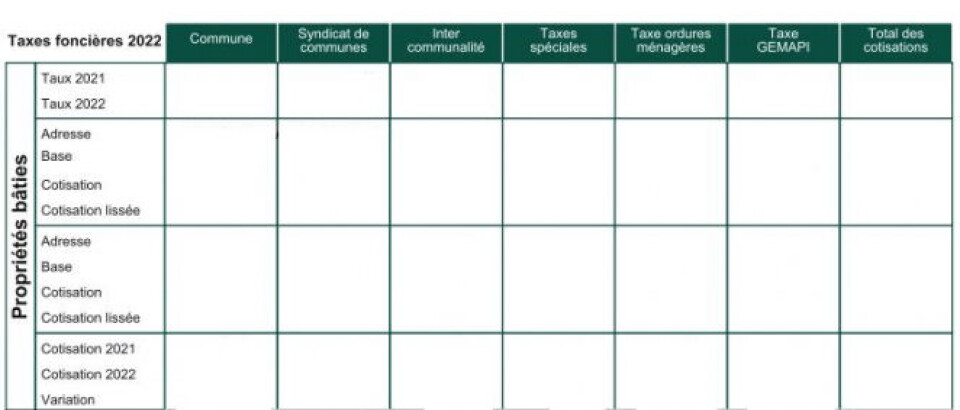

In line with rises in the taxe foncière across France, the taxe sur les ordures ménagères , which pays for bin collection, has risen too. We look at how much it has risen and why.

As French property taxes rise, so too does the bin collection tax. Here is our look at why this happens and how it affects you.

Bin collection in most of France is paid for by the taxe sur les ordures ménagères, which is levied by each commune along with the taxe fonciere. Some places, such as Besancon, use a different system based on a flat rate redevance.

This year has seen the taxe foncière rise across the board in France, in the biggest increase since 1986.

Read more: Why French property tax shows big increases

How are the bin collection taxes calculated?

- The standard model is for communes to use the valeur locative de la propriété foncière, which is the theoretical rental value of a property.

- This value is then divided by two.

- Communes then apply a rate onto this value

For example, for a Paris apartment:

Theoretical rental value: €6,000

Taxable value (half of theoretical value): €3,000

Commune rate for taxe ordures ménagères: 8%

Total bin tax = €240

Where to find my taxe sur les ordures ménagères?

The bin tax appears on the second page of your avis de taxe foncière.

Where has it risen the most?

The biggest rises have been in urban areas.

Ivry-sur-Seine (Val-de-Marne) has seen its rate soar by 44.3%.

Seine-Saint-Denis , Sevran and Tremblay-en-France (93) by +40.6%

Aix-en-Provence and Vitrolles (13) 32.1%

Read more: Which French towns or cities hiked their property taxes the most?

Why has it gone up?

The theoretical rental value of properties is calculated using an index of the global value of consumer prices. Increases in these values over the past have led to a 7.1% increase in theoretical rental value.

In addition, the removal of the taxe d’habitation for first homes has meant that many communes have less money at their disposal.

This has driven some communes to increase their bin collection rate to keep up with expenses, particularly communes in urban areas where public utilities (and costs) are shared with other communes via an Établissement public de coopération intercommunale or EPCI.

This tax is not dependent on the service delivered or on the quantity of waste collected. So even if you do not use the service you must pay the tax.

However, if you are absent from your home for more than three consecutive months for reasons outside of your control, you can ask the local centre des finances publiques for a reduction.

Read more:

Taxe foncière explainer: Who pays and the exemptions

How to dispose of different waste items in France