-

How long does it take to sell property in different areas of France? New study

Many major cities are showing signs of recovery when it comes to supply, demand, prices, and time to sell

-

Why more than half of French households do not pay income tax

Tax credits, ‘parts’ system and tax band increases all play their part

-

Vast majority of French departments opt to increase property notaire fees

What difference will it make to buyers and sellers?

Selling a second home in France: What has Brexit changed?

French Tax Online outlines how Britons owning a property in France that is not their primary residence will be affected if they decide to sell

Brexit has brought about many changes in several areas of everyday life for readers, and Britons owning second homes in France will be affected if they decide to sell their property.

As UK nationals ceased to be treated as EU citizens on January 1, 2021, there are two major consequences regarding the sale of French property:

Main homes are not affected. These changes relate only to the sale of a second home in France by Britons living in the UK.

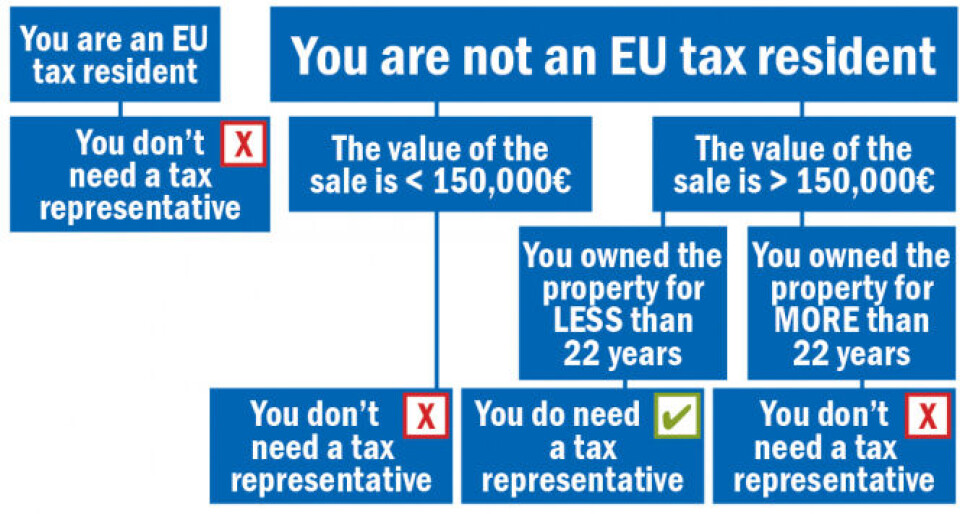

The chart below shows if you need the services of a tax representative or not:

The sponsors of this column are tax representatives in France and would be pleased to support you with this obligation in order to make the sale as smooth as possible.

This column is sponsored by French Tax Online, a company owned by Géraud Nayral, a French Chartered Accountant. The bilingual team at French Tax Online assist English speaking clients who live or are invested in France ensuring they comply with French tax obligations and declarations and includes completing French tax returns online for clients. French Tax Online is only able to answer queries if retained on an advisory basis. See frenchtaxonline.com or call + 33 6 68 92 19 25

Related stories

Your Brexit questions: Second homes in France

Succession in France: How is your family affected?

What happens if inheritance debts outweigh assets in France?