-

Graph: Record international investment in France announced

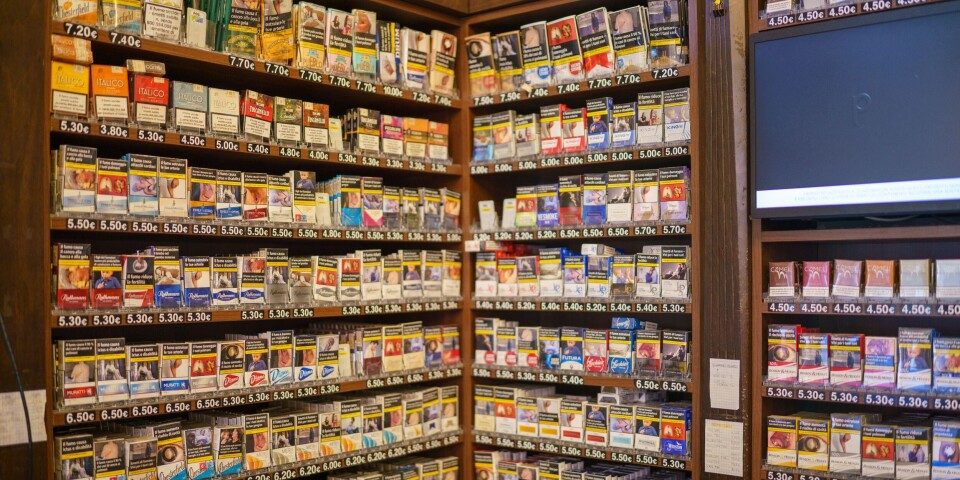

France is ‘most attractive' European country for investment says government

-

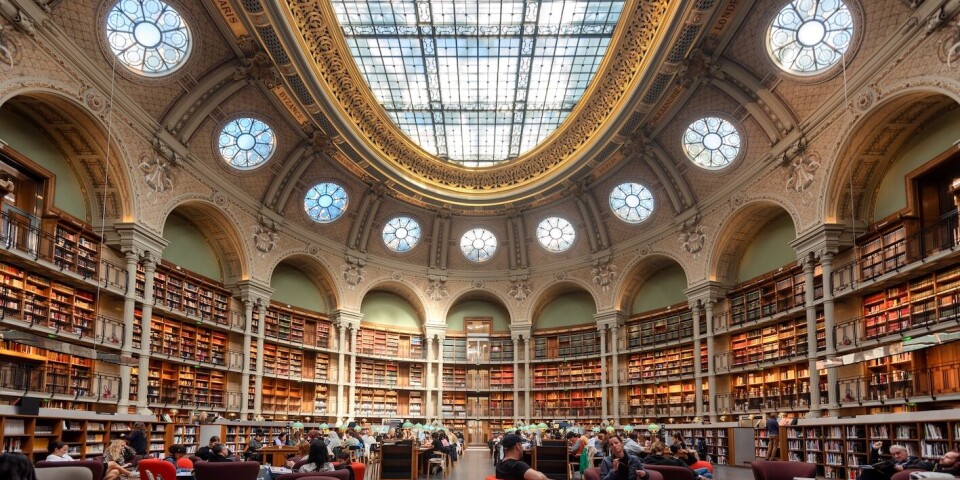

What are the jobs you cannot do in France with ‘auto-entrepreneur’ status?

The status offers tax and administrative advantages, but has strict rules about the professions allowed

-

VAT on small businesses: French MPs call for no reduction in threshold

Plans to lower the threshold to €25,000 would hurt micro-entrepreneurs and ‘massively destroy activity and wealth’ say critics

Tax at source for new businesses in France

I started my artisan business in 2018 - how will this work with the tax at-source system which started this year? F.I

There is no tax payable on your 2018 income due to the fact that a tax credit is applied to regular income from 2018 as part of the change to the tax at-source system.

However, you do still need to declare your 2018 income this spring. Assuming you are not using the micro-entrepreneur's optional libératoire method, for tax instalments under the at-source system you can opt now to start paying them based on your estimate of what your 2019 earnings will be (see Gérer mon prélèvement à la source in your personal space on the tax site); if you are on the micro regime, this is turnover minus the micro abatement.

If you do not do this, then you will pay tax for 2019 in September 2020. The tax office will calculate instalments from September this year based on your declaration this spring.

This question was answered by Olaf Muscat Baron who is a Fellow of the Chartered Association of Accountants UK, a French expert comptable and an International tax advisor.

He is the principal accountant of Fiscaly, an accountancy firm based in the Dordogne.

See www.fiscaly.fr or call 09 81 09 00 15